With the gradual internationalization of the Renminbi and steps taken by Chinese regulators to open up their onshore bond market, global investors are starting to increase their exposure to China’s RMB bonds.

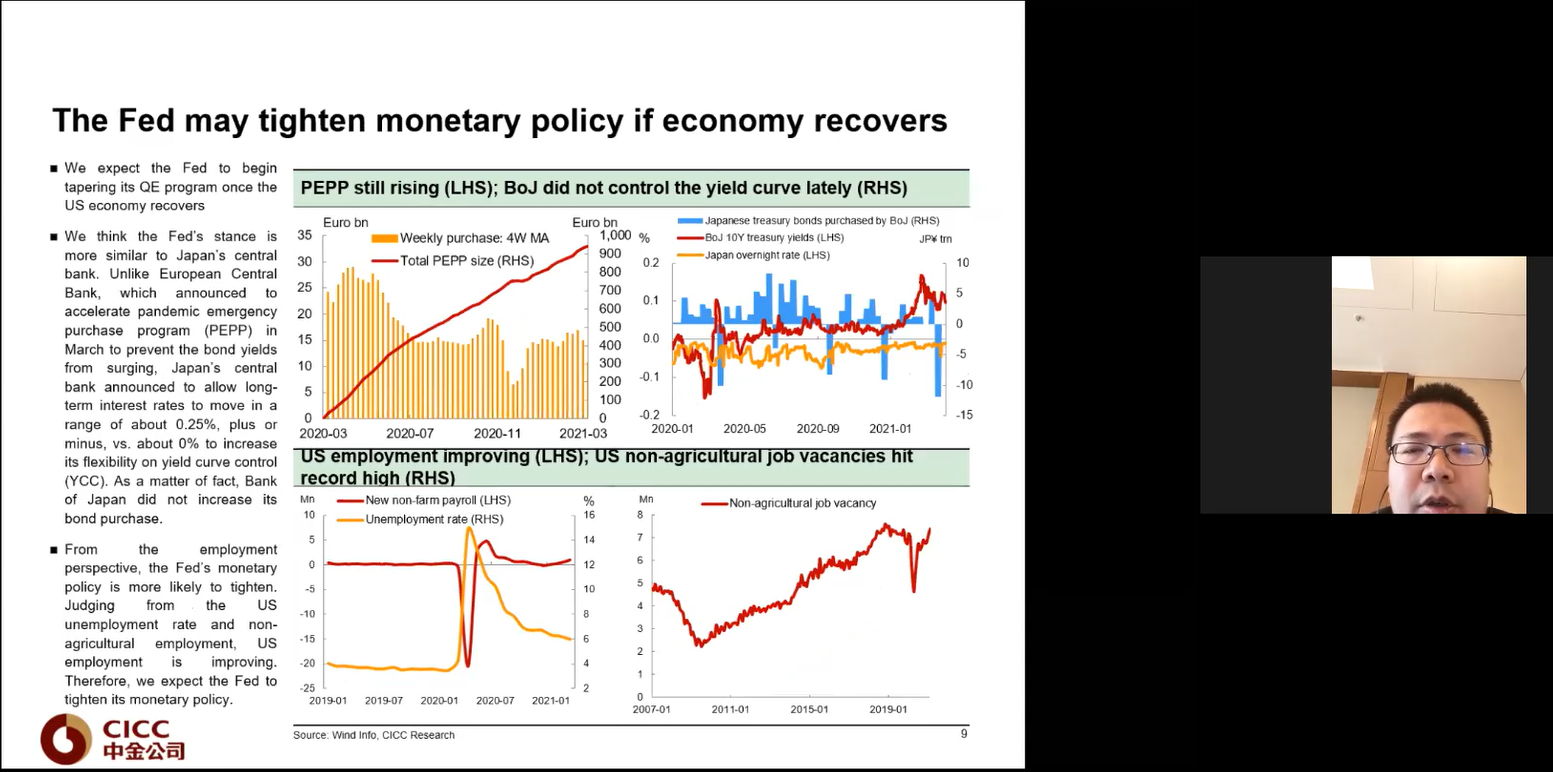

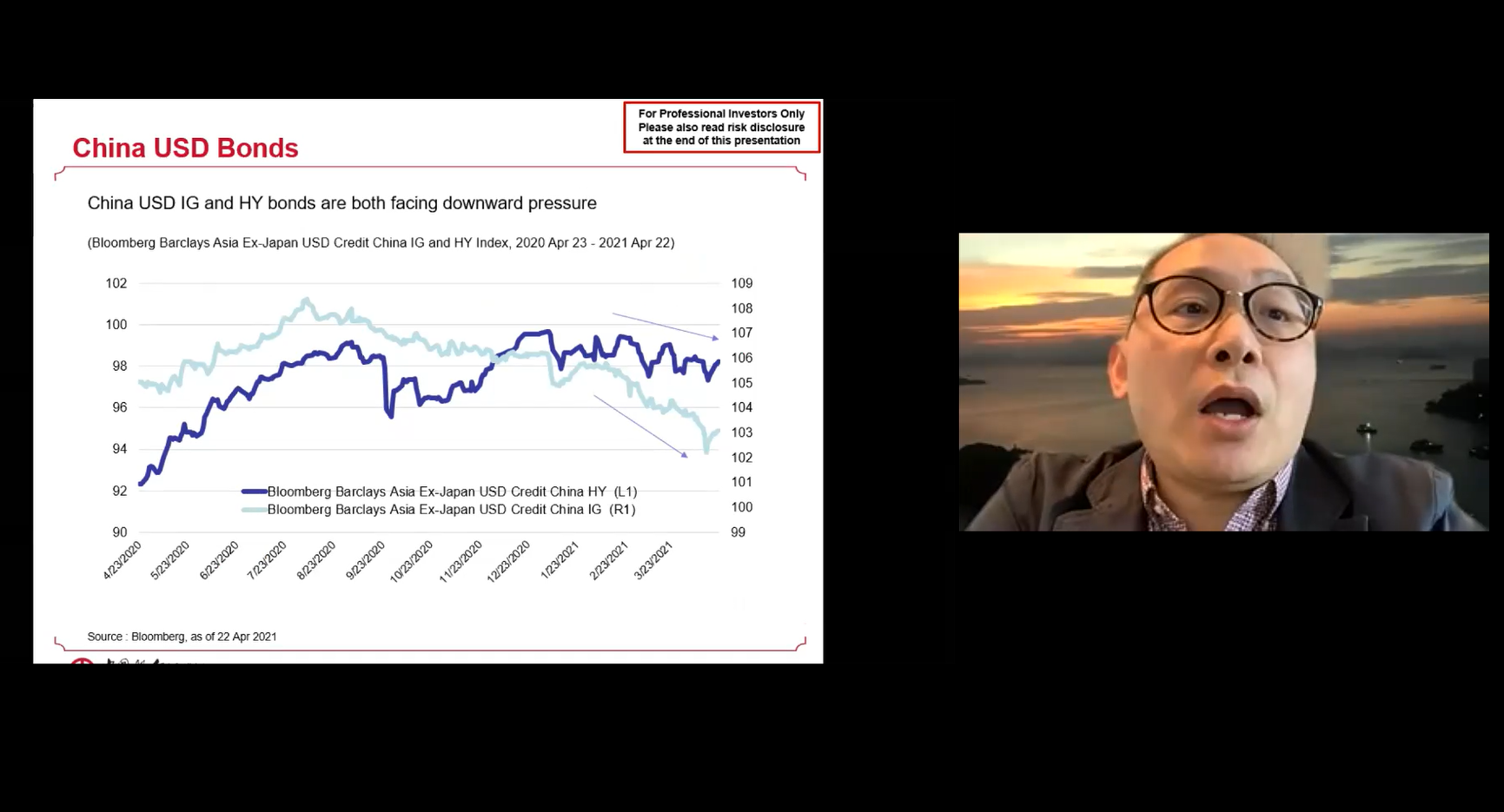

PWMA recently collaborated with the Hong Kong Investment Funds Association (HKIFA) in organizing a webinar “Developments of the China Interbank Bond Market (CIBM) and the Role of RMB Bonds” on 27 April 2021, inviting experts from China Central Depository & Clearing Co., Ltd. (CCDC), China International Capital Corporation (CICC), Bank of China (Hong Kong), CSOP Asset Management, L&R Capital Shanghai and ChinaBond Pricing Center to examine how the China bond market has evolved. Speakers discussed factors positively impacting the appeal of RMB bonds, including the comparative outlook for interest rates in China vs. the US, relatively high yields compared to bonds in developed markets and the potential of China’s green bonds. They also talked about the advantages of trading bonds directly through CIBM vs. the Bond Connect scheme.